Related Articles

A reliable payment processor is key to gaining loyal customers. Therefore, while commencing e-commerce, it is crucial to find an accurate payment processor. Since all your customers will be able to buy your products/services through your payment processor, it is essential to figure out if that route suits you the best or not.

There is an end number of reliable payment processors available in Canada, so it can be tough to pick the right one for you. Furthermore, you cannot just go with any of the options available because payment processors will directly deal with your transactions. Hence, it needs to be reliable and incredibly authentic.

We’ve filtered some of the top-notch, reliable payment processors for new e-commerces for your convenience. These are some best options you will find across Canada’s market. Here you can briefly check the rates, features, and fee comparisons.

Popular payment processors in Canada – Features, Fees, Rates, and Comparison

To give your newly started e-commerce, have a look at the features, fees, and rates of the well-known e-commerce reliable payment processors in Canada.

Stripe

Starting with the most popular and straightforward, reliable payment processor ”Stripe” for all types of businesses. Be it a startup or a large enterprise; Stripe extends its services to all. Its APIs and software are used to send payouts, manage a business online, and accept payments. It provides well-rounded features, which makes it a perfect solution for new businesses especially.

The ”PAY AS YOU GO” plan by Stripe will charge only when you make any sale. For each successful transaction, you will have to pay a flat 2.9% + $0.3 per transaction. You just pay for what you use in simpler words, which means no monthly, setup, or hidden fees.

No monthly fees help you to overhead at a minimum, and it is a significant benefit for a new startup. Yet another advantage here is the simplicity. Transparent and straightforward pricing by Stripe helps you to control and predict your costs. In addition to this, Stipe comes with a vast range of options plus features to satisfy all e-commerce needs. It includes a full stack of payment methods such as Amex, Visa, Mastercard. In addition to this, it also provides customizable checkout forms.

There is no verification process to get started with Stripe making it an easy-to-use reliable payment processor in Canada. Within a matter of minutes, one can begin accepting payments by using the fantastic Stripe,

PayPal

One can never miss PayPal if talking about Canada’s famous payment processors. It is a widely accepted method for transactions. Be it accepting, or sending one can use it without any fear. In the context of e-commerce, PayPal serves up two offerings: PayPal Standard and PayPal Pro.

1. PayPal Standard

The standard service by PayPal is the most convenient and popular methods to accept payments via credit and debit cards. Furthermore, it is free of overheads and only costs you a flat rate fee of 2.9% + $0.3 per transaction. You only have to pay when you make any sales. There are absolutely no charges as well.

One more thing that you should know if you opt for PayPal is that t will not allow the customers to complete the transaction from your e-commerce. It will redirect the customers to the checkout page hosted from the PayPal end.

However, it can be seen in many payment processors, but it can impact your conversions. Some consumers get discouraged by this process, which can lead to a business loss. The chances of such loss are rare but still there!

2. PayPal Pro

Another fantastic option that PayPal provides to help your business is ”PayPal Pro”. It is super customizable and accepts payments directly to your website. The best feature of PayPal Pro, which you do not get in PayPal Standard, is that it allows your customers to instantly pay on your website instead of getting redirected to a page hosted by PayPal. Yes, it helps you to gain the trust of the customers. It provides a seamless buying experience.

Same as PayPal Standard here, also every sale will set you back 2.9% + $0.3 per transaction. You also have to pay monthly charges of $35 CAD (+HST) for the Pro plan. There are some more features that you might miss in the Standard plan of PayPal, such as:

· You can host and design the checkout pages.

· Making direct and secure API calls

· In real-time, authorize transactions.

· Providing consumers with a streamlined checkout experience

· Provides Virtual Terminal which can turn any computer into a credit card terminal

Moneris

Well known for being Canada’s largest financial technology company, ”Moneris” provides the best payment processor services for e-commerce. It is different from Stripe and PayPal as it is the more traditional payment processor. It processes more than 3 billion debit and credit card transactions across North America, which is enough to show its authenticity. It brings you quality services.

It is a perfect solution for the people running a physical store with POS equipment and card processing. ”Moneris Gateway’Gateway’ for e-commerce is one of the ideal multi-functional online payment solutions. It includes all the vital features that one can expect, such as shopping cart integration, PCI compliance, Vault to store recurring customer data, etc.

Apart from this, there are many other vital reasons to pick Moneris, such as:

Multicurrency Support

It accepts both U.S and Canadian dollars. All you need is to have a merchant account for each currency.

Fraud Inhibition Tools

The updated security features of Moneris are yet another factor to choose it. Its AVS / CVV handling for increased security makes it perfect for new businesses.

Factors to Consider While Choosing Payment Processor in Canada

Now you have ample plus reliable payment processor options to choose from. But now, how will you pick one of them? What factors will you consider? Do not worry! Here are some fundamental yet vital aspects of your business that you need to re-consider.

What Payment Methods Your Customers Will Prefer The Most?

You exist for your customers! Therefore, it is essential to know what payment method your customer uses and prefers the most. So far, AMEX offers the best rates. If you are selling as B2C, then you should go for PayPal. It is extremely easy for the customers to use and will help you to boost conversions.

Do you Sell Just Online or Physically?

If you own a pure e-commerce store, then starting off with PayPal or Stripe will be best. But if you run both physical or online stores, then you would require POS hardware. However, PayPal offers Virtual Terminal, but the rates are not that impressive:

- Domestic 3.1% + $0.3

- International 4.1% + fixed fee depending on the country

- US 3.9% + $0.3

- 3.5% for AMEX

- Furthermore, Moneris provides professional POS equipment such as PIN pads, card terminals, iPads, etc.

Do You Sell Internationally or Domestic?

It is a must for you to consider the location you are selling your services and products as e-commerce. It is crucial because of the fact that transaction rates might vary broadly between domestic (Canada) and international payments.

If we talk about Stripe, then it will charge an extra of 0.6% for all payments made outside of Canada. This works out to 3.5% + $0.3 per every international sale.

On the other hand, PayPal asks for 3.7% + $0.3 for the United States as well as another 3.9% + fixed fee (dependent on the country) for international payments.

FAQ’s About Payment Processor

How is Payment Processor Different from Payment Gateway?

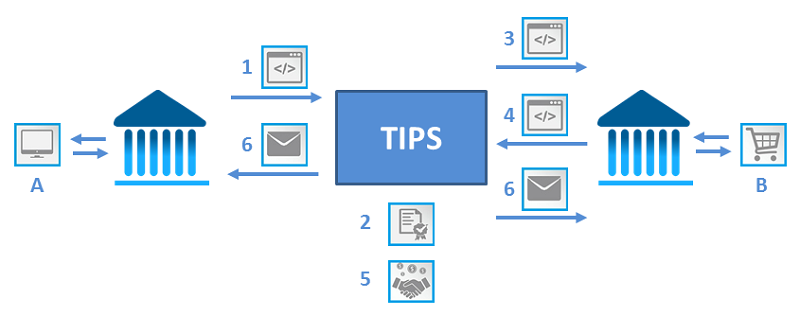

In a nutshell, Payment Gateway is a service that facilitates merchants to accept payments online for their e-commerce easily. Whereas, Payment Processor communicates with the consumer card issuer. It is done to ensure that there is sufficient balance to make a purchase for successful transactions.

Is it Possible to Use Multiple Payment Processors At Same Time?

The answer is yes. One can use various payment processors for their e-commerce store.

Conclusion

Picking the perfect payment processor for your e-commerce store is crucial. For the new startups, it is essential to figure out reliable processors to gain customers’ faith. A smooth plus safe payment processor can build a strong connection between your online store and customers. Hence, consider these factors for a good headstart!

Need more info on this? Let us help you.