Related Articles

If you do own one, however, maintaining accounts and finances are one of the – if not the – most important aspects of owning a business.

Payrolls, taxes, bills, and other expenses need to be continuously checked to ensure there aren’t discrepancies.

Let’s be honest, nobody actually enjoys crunching the numbers. The only thing business owners care about is growing their businesses.

As Eliyahu M. Goldratt said, “Cost accounting is productivity’s public enemy number one.” Luckily, there are a plethora of accounting tools available in the market that will take care of the numbers for you.

In this article, we will focus on the best available cloud-based accounting tools that can help you grow your business. Stick around till the end, and you might just find the solution you are looking for.

Types of Accounting Tools

Most of the accounting software on the market these days have a combination of several functions at different prices.

Before going in-depth with them, it is important that you assess your options based on what you need. There are several types of cloud-based accounting tools available on the market.

The first and probably the most common accounting tool is used for billing and invoicing. It doesn’t matter if you own a corporate business, you own e-commerce business or a small private business, you will need to keep track of bills and invoices.

Not only does keeping track of regular expenses and invoices require constant attention, but there is no room for error if your aim is to build a credible business.

The next essential function of your business must meet employee salary management. It is crucial for you as a business owner to be in control of the earnings and expenses of your company.

A payroll management tool can help you in this particular case.

Calculating employee salaries and taxes, necessary deductions, depositing the salary directly to their accounts, etc. are some of the primary functions of a payroll management system.

It is always wise to invest in a payroll management tool to streamline the business process.

Enterprise Resource Planning or ERP is another factor to consider for any business. These systems are considered the heart of businesses that involve product planning, buying raw materials, keeping an updated inventory, product distribution, marketing, and so on.

ERP also plays a vital role when it comes to CRM, or Customer Relation Management, and helps the business owner make informed decisions that could potentially save his business a significant amount of cash.

Finally, there are time and expense management tools. These systems are designed with the sole purpose of speeding up business operations. Collecting payments faster and reducing the delay between transactions are the main advantages of these systems.

Not Using an Accounting Tool?

You are probably reading this article because you are currently not using any accounting tools, are using them but are not completely satisfied, or are satisfied but still looking to find out how you can get more value for your money.

Let us discuss what the limitations faced by a business sans accounting tools are (keep in mind that if any of these are relatable, we have good news for you):

- Tax Errors: If you own a business, you have to file your taxes regularly. It is probably that one or more mistakes will be made while calculating taxes manually. Even a small error can cause a big problem.

- Budget: Every business needs proper budgeting to run efficiently. As a business owner, you need to foresee future costs and make sure all financial necessities are taken care of. Electric bills, employee salaries, and other expenses are all part of the budget that needs to be addressed. Using an accounting tool for budgeting will help you keep track of the cash flow of your business, but no accounting tool will help you think of the components of your budget. The most they can do is offer suggestions, but at the end of the day, most of it comes down to intuition and experience.

- Payable Accounts: A business often has a set of accounts that need timely deposits to keep the business running smoothly – bills, for example. Keeping a record of each bill paid and due can help avoid future confusion. Maintaining regular payment schedules can be a cumbersome task as humans are prone to errors.

- Receivable Accounts: If money from the business is going somewhere, it has to come from somewhere. A receivable account keeps track of all the sources that money is coming in from. Overall income and revenue are determined by this account, so if you let uncollected payments slide, your business might not survive very long.

- Human Error: When it comes to accounting, a lot of numbers are involved – and I mean a lot. Naturally, a human would be prone to errors when handling so many numbers and accounts. Keeping a full-time accountant is also a hefty expense.

Now that we have taken care of the preliminaries, we can now dive deeper into the discussion about cloud-based accounting tools. Below is a list of some of the best accounting tools of contemporary times. They are not listed in any particular order, and each of them is great in their own way.

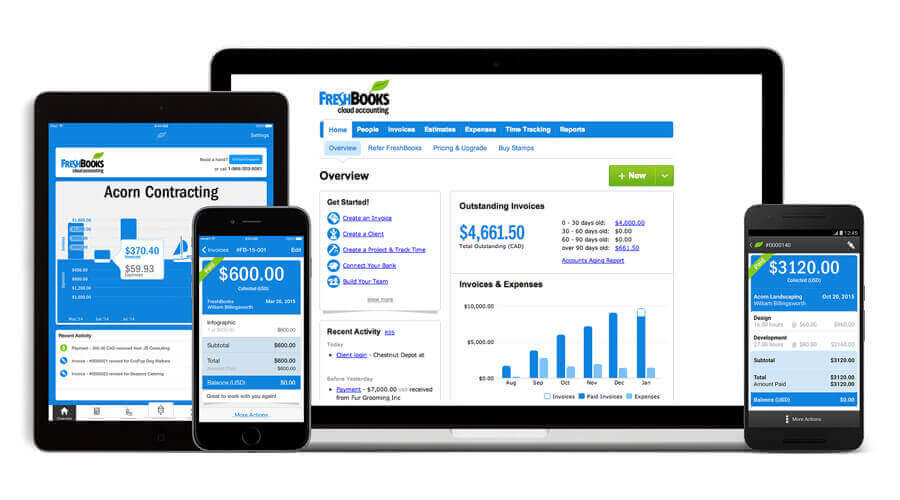

FreshBooks

FreshBooks is one of the simplest accounting tools you can find on the market. It was designed keeping small businesses in mind. “Ridiculously easy to use” is a line directly quoted from their website. FreshBooks is a cloud-based accounting tool that also allows you to connect with industry leaders to enhance your contacts and help your business grow. It is equipped with all the features you need, including:

- Invoicing: Professional invoices created within seconds. Helps create a unique impression on your customers.

- Expenses: The days of saving receipts are long gone. You can keep all your expenses in check with FreshBooks.

- Time tracking: This is a great feature when it comes to making invoices. FreshBooks keeps track of your and your employee’s work hours to create a more accurate and fair invoice for the client.

- Projects: Keep all the project files organized in one place. The best part about it being a cloud-based tool is that it automatically updates all systems in your network.

- Get paid faster: FreshBooks offers online credit payments, which means you don’t have to wait for customers to make deposits. You can get paid up to 11 days sooner.

- Simple reports: FreshBooks generates simple business reports which can help you assess how your business is performing. These reports are made easy to understand for the business owner.

- Mobile app: The FreshBooks mobile app is also connected to the cloud server, allowing you to operate your accounts anytime you want, and from anywhere you want.

All these features come at a very affordable price of $15/month for the LITE version and are definitely worth the money all things considered. The best part is that you get all the features of the premium version. You will only need to upgrade your membership as the number of your clients’ increases. FreshBooks also gives you a one-month free trial, no credit card details required!

Disadvantages

No system is perfect. Although FreshBooks has overcome most of its flaws over the years, there are still some issues that users face.

One of them is single-entry accounting. While a single-entry accounting system works for small businesses, the problem is painfully apparent when more and more accounts are created.

There have been reports of issues that caused some users to switch platforms as well. Overall, FreshBooks is probably the best entry-level accounting software you can get your hands on.

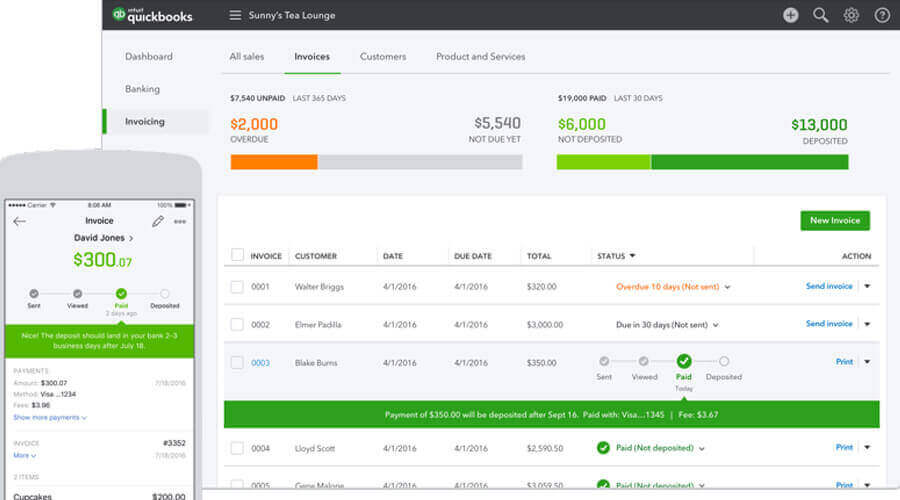

QuickBooks Online

QuickBooks is another popular platform for managing your business accounts.

Unlike FreshBooks, QuickBooks comes in two different variants. One is the basic Desktop version, and the other is QuickBooks Online, which provides cloud support.

As our topic today is cloud-based accounting tools, we will stick with QuickBooks Online. QuickBooks Online offers many great features that can benefit your business:

- Sync: One of the most painful aspects of accounting is updating all the related accounts on your system. QuickBooks Online lets you connect all your business accounts, with all your deposits and withdrawals automatically updated in real time. As it also categorizes transactions automatically, you can keep accurate records of those transactions.

- Expense tracking: QuickBooks Online is an excellent tool for keeping records of your expenses. On it, you can sort bills according to your needs, record what you are paying for, how much you have to pay, and whether it has been paid or still due. Moreover, you can even schedule payments according to when they are due. With QuickBooks Online, you will never fall behind on bills.

- Digital invoicing: Most businesses invariably create a lot of invoices. You can create your own customized invoice to send to your customers – just add the customer details in QuickBooks Online and set the appropriate parameters.

- Direct payment: The customer can even pay you directly through the QuickBooks Online payment portal. For a few extra bucks, you can link online payments such as credit or debit card payments directly to your account. Now you no longer have to wait for customers to make deposits.

- Inventory management: Inventory management is as easy as it gets with QuickBooks Online. Buying and selling of goods will automatically update the inventory in real time.

- Reports: Getting accurate reports is another essential factor in operating your business smoothly. QuickBooks Online is capable of all kinds of analyses and can produce reports that can help you make informed business decisions.

Now let us come to the pricing and plans.

QuickBooks Online lets you choose from 4 different plans. The SELF-EMPLOYED plan is for freelancers and starts at only $10.00/month. QuickBooks has optimized the EASYSTART, ESSENTIALS, and PLUS plans considering small businesses on a budget. EASYSTART is $13.00/month but is missing some great features. ESSENTIALS is a great place to start for $27.00/month, and finally, you can enjoy all the features for only $40.00/month with the PLUS plan.

Disadvantages

The main issue with QuickBooks Online is it might be slightly expensive if you opt for advanced payroll management.

If you have a lot of employees to pay, FreshBooks might be the better option for you. With QuickBooks Online, you must pay extra for the features and a further $2 for each employee every month. Additionally, there have been reports of double entries and system crashes on the user side.

System integration, despite all its advantages, might be another issue on QuickBooks Online. Overall, QuickBooks online is a great accounting tool for your startup business, and the interface is easy enough that you do not have to spend hours training to learn all the technical terms.

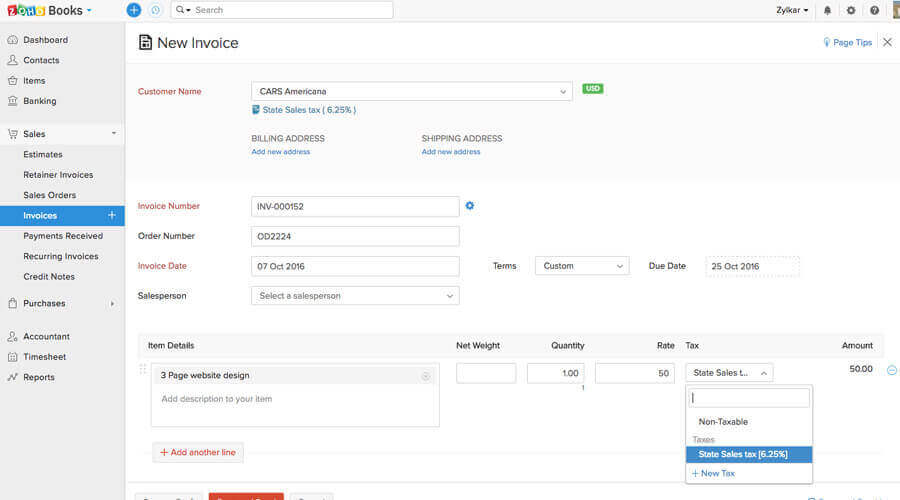

Zoho Books

Zoho Books is another great cloud-based accounting tool. It is almost on the same page with FreshBooks and QuickBooks Online.

QuickBooks Online is developed by Intuit, which is a specialized financial services company. Zoho, on the other hand, is an integrated application provider and Zoho Books is one of their products. It won “The Sleeter Group Awesome Application” award in 2015, “Category Leader” award in 2016 for GetApp and is in the editors’ choice list for pcmag.com.

Let us take a look at the features that Zoho Books offers that brought it this fame and recognition:

- Client portal: One feature where Zoho Books that stands tall is its client portal. You can ask for feedback from your clients and improve your business accordingly. You can even share the feedback on social media to improve your customer engagement. Eliminate the need for long e-mails and waiting for responses. Speed up the whole process through instant messaging.

- Estimates: You can create customized estimates and send them to the clients. If the estimate is approved, you can convert it to an invoice with just a click.

- Sales orders: Sales orders are really important to keep track of no matter what you are selling. Zoho Books offers you customized sales order templates where you can add your own logo and fonts in order to give it your own personal touch.

- Tax: Tracking all your transactions allows Zoho Books to calculate your tax liability as well. Letting Zoho Books take care of your tax calculations is the best way to be ready when tax season hits.

- Automation: Having to do repetitive work hinders the productivity of a business. Zoho Books can take care of redundancies like sending out invoices, payment reminders, scheduled bills, etc.

Zoho Books also offers similar features of FreshBooks and QuickBooks Online like invoicing, bank synchronization, reporting, inventory management, etc. It comes in three different versions – BASIC for $9.00/month, STANDARD for $19.00/month, and PROFESSIONAL for $29.00/month. Choose your preferred package depending on the size of your business and how much you can afford to spare on an accounting tool for your business, as all three versions are great in their own way. You can opt for a 14-day free trial period to help you make up your mind.

Disadvantages

A dedicated payroll management system is not available on Zoho Books. This feature is only limited to users in California and Texas. Other than that, Zoho Books is a fantastic accounting tool that also offers cloud support, meaning you can operate Zoho Books from anywhere and with any device. Pcmag.com put Zoho Books in their editor’s choice for a reason!

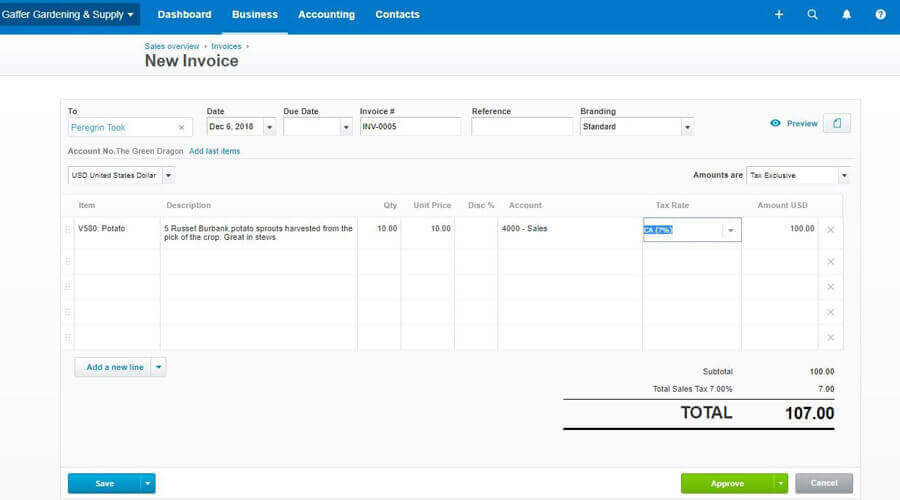

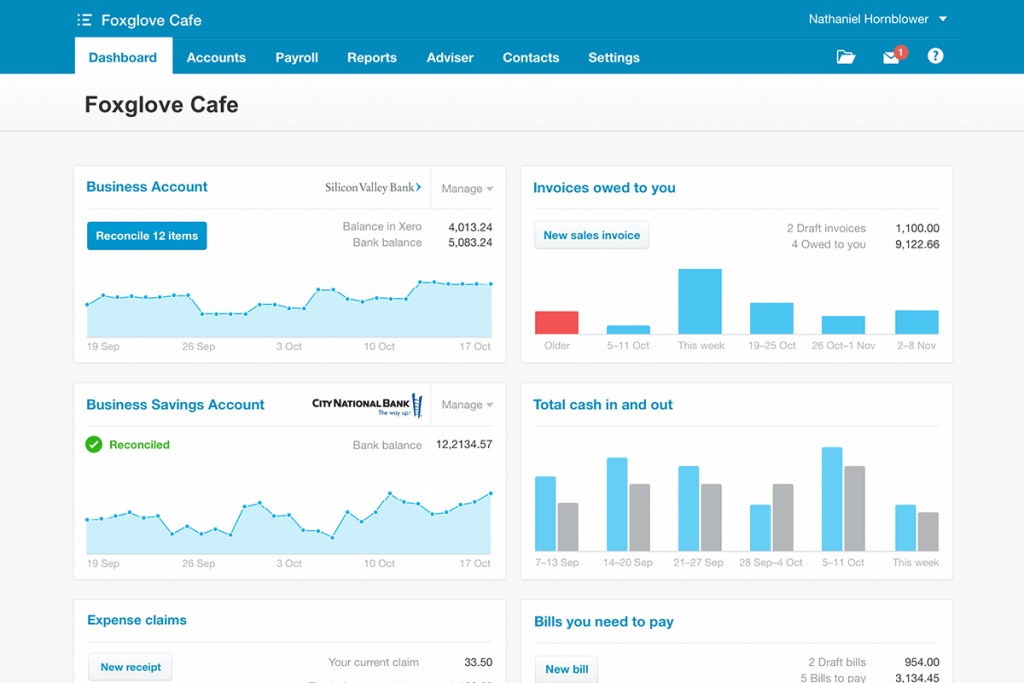

XERO

Xero is an unconventional accounting tool for small business owners. This is an accounting tool that covers every financial service there is and is a double-entry tool.

Xero also supports any documents from QuickBooks Online. It stands out in that it has a rather different user interface compared to the accounting tools discussed above. Why should you subscribe to Xero, you ask?

- Security: Xero offers an extra layer of security for all your online data that is traveling in and out multiple times a day. The controls are totally up to you. You choose who has access to your files, and your private data remains private with Xero.

- Project management: Xero’s project management feature allows you to track each of your projects’ progress individually. It can keep track of time, create invoices and boost overall efficiency. All of these are done automatically, and updates are sent as soon as there is a change. These are called triggered updates.

- Bank reconciliations: Xero discreetly imports all your transaction data from your bank and updates them for you with your permission. All your data is safe with Xero’s added encryption, and you can save more time to work on things that help grow your business.

- Dashboard: As far as customization goes, your imagination is the limit. Xero even lets you customize your dashboard, where you can monitor all your finances in real-time.

- Xero Expenses: Xero Expenses is an integrated feature that enables you to keep track of all your expenses efficiently and eliminates the chances of getting charged more than you are supposed to.

- Integration: This is probably the most robust feature Xero can offer. Their website claims Xero can integrate 700+ business apps like Gusto, PayPal, Shopify, SQUARESPACE, etc.

You can experience Xero with a 30 day trial period, and as for pricing beyond that, things are a little complicated. The entry-level package is EARLY, which comes for $9/month. This cheap rate is justified considering the limited ability to send only 5 invoices or quotes, 5 bills, and the capacity to reconcile 20 bank transactions. The GROWING package is much more standard with unlimited invoices, quotes, bills, and bank reconciliations. This package costs $30/month, which is pretty standard. The ESTABLISHED version is much more expensive, with a price tag of $60/month, but it comes with multi-currency support, project and time tracking, and expenses tracking.

Disadvantage

As the pricing suggests, the EARLY and GROWING plans don’t bring much to the table, although the ESTABLISHED plan has everything you need with payroll management support in over 50 states.

Another issue with Xero is that it doesn’t have a client portal. As we discussed earlier, having a client portal can help you improve your business and shorten the time to complete transactions. QuickBooks Online, FreshBooks and Xero share a similar array of features. When considering an accounting tool for your business, do not fail to consider Xero as an option.

Wave Accounting

The main reason why you might want to opt for Wave Accounting is that it is free. Yes, the basic version of the accounting tool is completely free, and it is a double entry accounting tool.

If you work alone or are just starting out with a few employees, Wave is undoubtedly the best option for you. As pcmag.com states, “Not only is Wave the best free small business accounting website but it’s one of the best online resources periods for its target small business audience.” There is no way you can underestimate the functionality of Wave because they offer all the necessary features:

- Robust: Despite being a free accounting tool, Wave Accounting ensures all the security you need on your daily transactions.

- Ease of use: Wave accounting is surprisingly easy to use, and you can get started within seconds. Just customize your options, and all the features are ready for use.

- Cloud support: Wave Accounting is fully cloud-based, allowing you to access your data from anywhere, at any time.

- Bank connections: Just connect your business bank account with Wave, and all transactions will be updated on Wave automatically and in real time.

- Reports: Reports are customizable, and you can even compare monthly or annual reports to determine patterns of how your cash flows in order to make more informed decisions.

- Easy tax time: Wave makes sure all the data are in their place, and all the payments are taken care of. So, when the time comes to file your taxes, you don’t have to take out any of your valuable time to calculate it yourself.

There is nothing much to discuss pricing. As we mentioned earlier, the basic version is free. Meaning that you don’t have to pay anything for all the features we discussed until now. However, if you want payroll management, you can opt for the monthly plan, and you have to pay only $20/month with an additional $4/Month for each employee.

This service is exclusive to Canada and the USA, however. Also, the free version allows businesses to collect online payments, where Wave charges a minute 2.9%+30 cents for card transactions and 1% of bank transactions.

Disadvantages

We really should not discuss the disadvantages of a free cloud-based accounting tool in this competitive market culture, but for those concerned, Wave Accounting does not have a mobile app.

Moreover, dedicated time and project tracking services are not included in any of the plans. But with a free base version and the payroll management available at only 20 bucks a month, we really cannot complain.

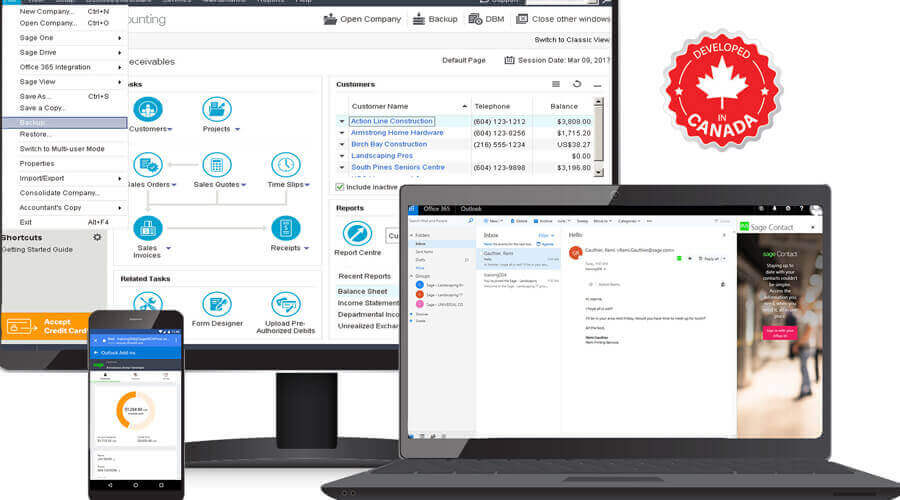

Sage 50Cloud

Sage is one of those accounting tool providers that has something for everyone. Whether you own a small business, medium sized business or a full-fledged corporate business, chances are Sage has an accounting tool you need:

- Sage Accounting is a stable finance handling software that lets you keep track of every penny you earn or spend, Sage 50Cloud is a desktop accounting tool with cloud support

- Sage Intacct is an advanced financial tool for medium-sized, high growing business

- Sage Financials is a tool for medium-sized businesses

- Sage 100Cloud allows you to track accounting, manufacturing, and distribution with the same tool.

- Enterprise management, Sage Fixed Assets, and People were developed by Sage keeping fully-grown, mature businesses and enterprises in mind. It is apparent that each of these tools has its own benefits and their own consumer base, but as we are talking about cloud-based accounting tools for small businesses or e-commerce, Sage Cloud50 is our focal point for today.

Sage 50Cloud is a desktop accounting solution that allows you to track, store and process all your financial data in one place, and features both system integration and cloud backup.

- Outlook connector: Sage 50Cloud lets you connect with your contacts on Microsoft Outlook to save processing time. You can access information about your customers such as credit limit, address, and so on from anywhere.

- Smart cloud: Sage 50Cloud offers a smart backup in the cloud where your data is encrypted and backed up regularly. It also has a version management system which lets you correct any wrong entries by simply restoring it to a previous date.

- Microsoft Office 365 integration: One of the unique features that Sage 50Cloud offers is system integration with Microsoft Office 365. All data you store locally on your system will automatically be imported in the Sage 50Cloud platform and be backed up immediately. Even if you lose everything in the event of a technical disaster, your data will still be safe and intact.

- Payroll management: Payroll management comes with every Sage 50Cloud plan. You can pay your staff online or deposit their salaries directly into their accounts. All of these expenses, including office bills, will be tracked and logged for your peace of mind.

Sage 50Cloud lets you choose from monthly or annual subscription plans. The Pro Accounting package will cost you $46.83/month. This might seem a little steep, but given the functionalities and state of the art customer support, it is well worth the damage to your wallet. The same plan for a one-year subscription will cost you $465.95. Both annual and monthly plans come with a $150.00 Microsoft integration option for one year. The Premium Accounting package comes for $72.41/month and $720.95 for a year. Finally, the Quantum Accounting plan will cost you $182.91/month and $1,834.95/year. The Microsoft integration option remains in the same price range for all packages.

Disadvantages

The first apparent con of the Sage 50Cloud accounting tool is the high price. The price is higher than any of the tools we have discussed so far.

The Sage platform is relatively harder to operate than systems like FreshBooks or QuickBooks Online – the customization options are difficult to figure out, which may lead to home page congestion and an inefficient working process.

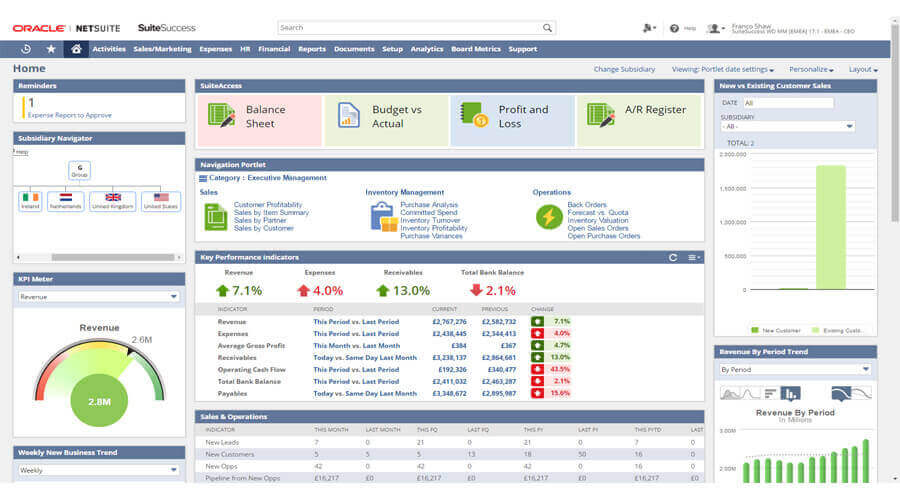

NetSuite

NetSuite is a business accounting tool developed by Oracle. For this reason, NetSuite is widely used around the world as a cloud-based architecture accounting tool. NetSuite offers excellent integration with all other business solutions provided by NetSuite, such as order management, inventory management, CRM, etc. NetSuite offers the following features:

- Revenue Recognition: NetSuite’s Revenue Recognition is a unique accounting feature that helps business owners make the right decision for their businesses. This feature tracks and maintains standard accounting features and generates timely reports.

- Financial planning: This feature helps business owners plan the future of their business using a smart budgeting tool, business data, and their own intuition.

- Billing: The billing feature in NetSuite eliminates any chance of wrongful billing of clients, maintaining your integrity among customers. It also helps the Revenue Recognition system to work flawlessly.

- Financial reporting: Generating proper real-time reports depending on business insights is another great feature of the NetSuite Accounting solution. This aids the entrepreneurs to make decisions timely and precisely. As Charles Scott said, “Creativity is great-but not in accounting.”

- GRC (Governance, Risk, and Compliance): NetSuite GRC is a great feature that most of its competitors lack. The technology helps monitor and address all issues regarding governance, and helps reduce enterprise risk.

When it comes to pricing, the actual fee is classified. You can schedule a free consultation with NetSuite on their website. You can also opt for the free demo period to see if you like it.

Disadvantages

The first things that come to mind are the absence of pricing on their website. This is a huge deal-breaker for some business owners. It is also widely considered that the user interface is not user-friendly at all, and their customer service is known to get mixed reviews.

Comparison

We have listed seven of the best cloud-based accounting solutions for you, in no particular order.

Each of these accounting tools is great in their own way.

FreshBooks is great for small businesses that are just starting out. FreshBooks is very user-friendly and easy to use, which eliminates the need to arrange training sessions for employees.

QuickBooks is similar in the category and is also a very reasonable option. The price range is identical to FreshBooks.

Zoho Books is a very strong competitor in this sector. The client portal and ease of use keep them in the race.

Xero is a great accounting tool option for small businesses, corporate, or e-commerce businesses. Although, to get the full Xero experience you have to pay more than FreshBooks, QuickBooks, or Zoho Books. Considering the added security and integrated project management features, however, Xero is an excellent choice.

Sage 50Cloud is on the heavier side when comparing prices for an accounting tool, but the importance of the features is undeniable. We have to say the Sage 50Cloud was designed keeping a “big business” in mind.

NetSuite is widely used around the world thanks to the fact that it is developed by Oracle Corporation. They have a few unique features to offer business owners, but their not-so-straightforward pricing and licensing policy pose a big red flag.

As it seems, each system has its advantages and disadvantages, but what is the best system suitable for you? We saved the best option for last.

Syncoria is a Toronto based software development company providing digital transformation solutions for over 14 years. Our crew has over 100 years of combined experience, and our clients are more than happy with our service.

Odoo is one of our partners, and it specializes in digital transformation solutions – including a cloud-based accounting tool. You can also become a member of the Odoo family with more than 3 million members worldwide. Here’s what Odoo can offer as your accounting partner.

- Beautiful User Interface: Based on Google Material Design trend, Odoo has a brilliant, convenient user interface.

- Ease of use: Setting up your accounting solution interface is completely customizable. The initial setup is easy, and anyone can do it without needing to spend hours figuring out what they are doing.

- Reduced data entry: Creating invoices, quotes, bills, bank statements; everything is automated and can be scheduled. The days of manual data entry are over!

- Automated banking: Odoo doesn’t stop at just connecting your bank accounts. Odoo allows you to sync everything including transactions, bank statements (OFX, QIF, CSV, CODA files supported), etc. Even the reconciliation is automated! Odoo has partnered up with more than 15,000 banks in the USA, Canada, and New Zealand. What more can you ask for when it comes to online banking?

- Clean invoices: Odoo customer invoices are very easy to create. You can include payment terms, tax details, your logo, and anything else you want in your invoice and create a lasting impression on the customer. Advanced payment terms like multiple invoicing, cash discounts and partial reconciliations are also possible with Odoo. Another great feature is the draft invoice. Draft invoices are created automatically whenever you receive an order.

- Easy payments: Online payments come integrated with the Odoo accounting tool. We are partnered up with the world’s leading credit card payment gateway companies like PayPal, Authorize.net, Ingenico, Ayden, and so on.

- Customer portal: Customers will have access to tracking their orders, invoices, and due payments. They can change their plans, upgrade, or downgrade according to their needs through the customer portal.

- Automatic follow-ups: Odoo allows you to schedule emails, letters, and tasks targeted to customers who have dues. When the time comes, customers will automatically receive a reminder that they owe you money. You also get full customer reports for analysis at your leisure.

- Expenses: Schedule and disburse employee salaries via your Odoo accounting tool. All expenses are recorded. You can get forecasts on what your future expenses are going to be and take necessary steps if need be. Bill checks can be printed in bulk with just a few clicks. You also have the option to schedule payments to suppliers. An automated alert is sent to your partner(s) and/or employees when an existing contract expires.

- Dynamic support: Odoo allows multiple currencies, users, company integration, and journals. You have complete control over your interface.

- System integration: Odoo is completely compatible and easy to integrate with other solutions for inventory, sales, purchase, e-commerce, and customer service.

- Budget and revenue: You can manage all your business assets and keep an eye on them. Odoo allows you to visualize a realistic budget after analyzing previous reports to make sure your money is being invested in the right place. You can easily track your budget and compare performance. Moreover, you can track all your revenue to make sure you are not forgetting to collect any of your hard earned money.

Choosing the right cloud-based accounting tool for your business can be a frightening task. But when you have Syncoria, you have nothing to worry about. Consult us for any of your business needs. The cloud-based accounting solution is just one of our specialties.

As Warren Buffett said, “Accounting is the language of Business.” We have the expertise and equipment to create just the system for you – whether it is an accounting tool, a website, an inventory management system, or otherwise. You name it, we got it. Visit our website and feel free to reach out to us for any questions.